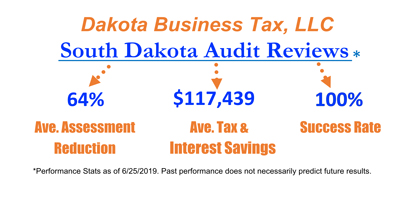

Reducing South Dakota Sales, Use, and Contractors’ Excise Tax Audit Assessments 64% on Average

At Dakota Business Tax LLC d/b/a DBT LLC, we are proud of our audit review successes. As of June 25, 2019, we have been reducing South Dakota audit assessments for those that have engaged us by 64% and over $117,000 on average per audit. Of course, past results are not a guarantee of future results, but we currently have a 100% success rate at lowering audits.

Auditors Can Make Mistakes

What this means is, just as good hardworking bookkeepers, controllers, and CPAs can make mistakes on what taxes are due, good hardworking auditors are not perfect either and can also make mistakes. Sometimes it is the misinterpretation of a particular South Dakota tax law or forgetting about an administrative rule that South Dakota has that exempts a particular sale from South Dakota sales or use taxes. Other times the auditor has a misunderstanding of how a product or service is actually used. How a product or service is used can change what initially appeared to be a taxable item to a non-taxable item that needs to be removed from the audit.

This is where Dakota Business Tax LLC can help. As a former South Dakota Sales, Use, And Contractors’ Excise Tax Auditor with over twenty-four years of experience, I can help in reducing South Dakota audit assessments because I know what is taxable in South Dakota, and more importantly, what is not. I know the questions to ask about a product or service to determine its taxability, and the documentation needing to be presented to the auditor so those non-taxable items that should not be in the audit finding are promptly removed.

Get Your South Dakota Sales, Use, or Contractors’ Excise Tax Audit Reviewed

Whether you are the bookkeeper, controller, or CFO, do not go it alone. Get your South Dakota audit findings a professional review to help ensure that you are not spending your employer’s or client’s money on taxes not due but keeping it for use by the business. If you are an attorney or accountant, and you reduce a client’s audit from $50,000 to $45,000, can you assure that client that they really owe $45,000 or do they really owe $30,000, $20,000, or maybe they owe nothing?

The reality for businesses is when Dakota Business Tax LLC saves one business $100,000 or even $10,000, and another business pays extra tax dollars they do not owe, it negatively impacts their profitability and puts them at a competitive financial disadvantage with their competitors.

Dakota Business Tax LLC is here to help

South Dakota sales, use, or contractors’ excise tax laws are a complex array of tax laws and administrative rules. As a former South Dakota state sales, use, and contractors’ excise tax auditor with over twenty-four years of experience, I bring not a broad understanding of South Dakota tax laws, but an unparalleled depth of understanding of South Dakota tax laws, administrative rules, and insight into a South Dakota tax audit. At Dakota Business Tax LLC, we believe the best results come to those that can provide the best team of experts available for their businesses or to their clients. In regard to an accounting firm, this helps retain clients and acquire new clients.

We do have contingency fee options, so you only pay our fee if we reduce your audit assessment.

Contact Dakota Business Tax LLC today at contact@dbtllc.com or call us at (605) 389-7345 to see how our South Dakota Audit Assistance and Defense services can help you, your business, or your clients, and to answer any questions that you may have.